You must be able to read and interpret sports odds in order to place profitable and intelligent sports bets. Three types of sports odds are commonly displayed: Fractional odds (Decimal odds), American odds (Fractional odds) and American odds. These odds can tell you how much you will win or lose, and what the chances are that it will happen. Make sure you choose the most valuable odds when selecting which ones to bet on. Remember that sports betting results are subject to many factors so relying solely on the odds is not advised.

Decimal odds

You may have heard of decimal odds, but you may not know how to read them. If you don’t know what decimal odds are, it can be difficult for you to make a betting decision on a certain sport. They are much more understandable than fractions. This handy calculator will help you determine decimal odds.

You'll see decimal odds on points spreads or totals in most sports betting situations. For example, 1.13 is the odds that the Chiefs will be the heavy favorite. Meanwhile, the Steelers are 6.50 on the moneyline. Although the odds of winning these games are comparable, they are still very different.

American odds

American sports betting is something you might be familiar with if your passion is football. These are the odds of a particular game being played, and they are used in sports betting. The market determines the odds for each type of game, so they are subject to change at any point. You need to know how American sports odds work, and what they mean if you want to place a wager on a team.

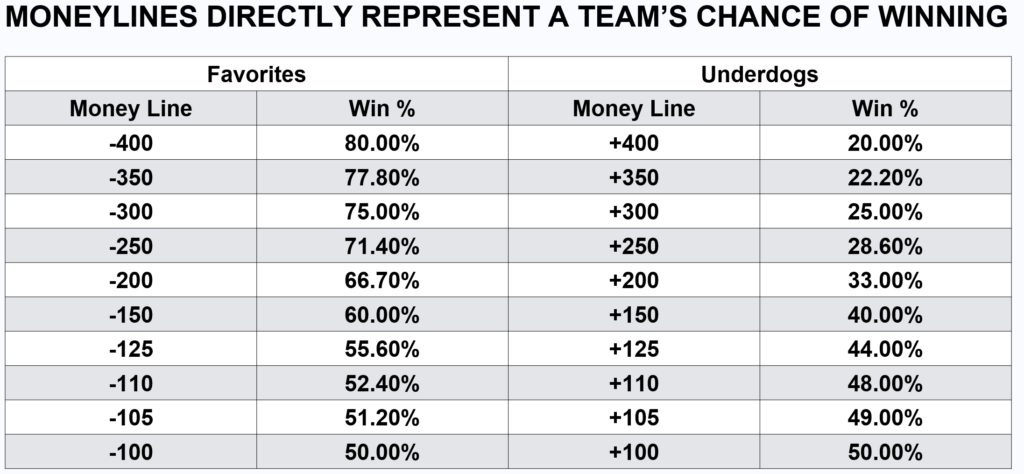

The odds of success are expressed in positive or negative numbers. The negative number indicates the team that is favored, and the positive number signifies the underdog. Spread is the most common type of bet. It evens out the playing fields between two teams.

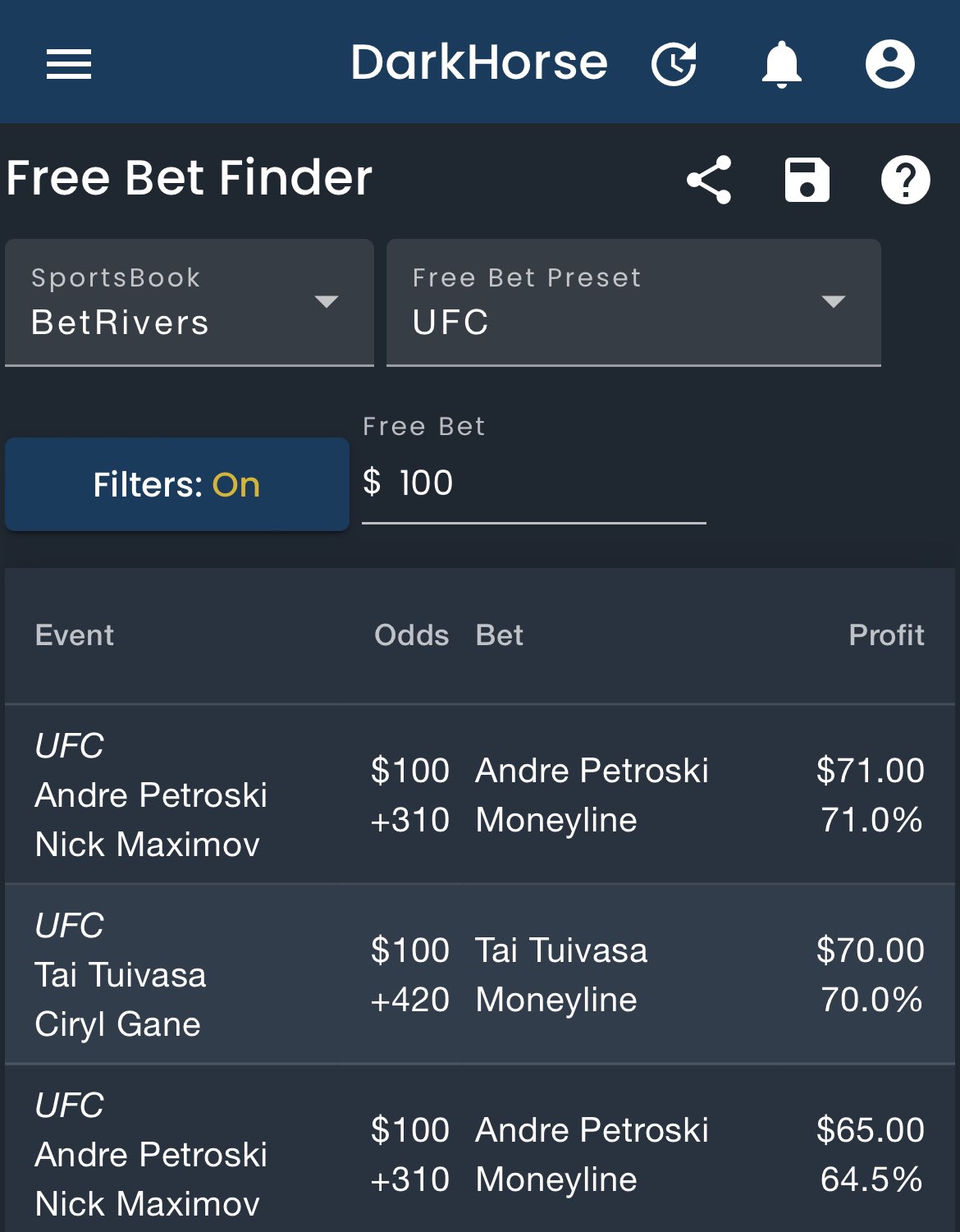

Moneyline odds

There are many ways to place a bet on sports. Understanding how moneyline odds work is key in predicting winners. Moneyline odds are determined by computing implied probabilities. Moneyline odds will rise if a team is expected to win. The moneyline odds are lower if the team is underdog.

The moneyline odds take into account the matchups of the team, in addition to the implied probabilities. One example is that a team that is heavily favored to win could struggle to contain a running back pass-catcher. An opposing team might have a strong offensive line and struggle to stop a powerful guard. Hockey and baseball also require special considerations.

FAQ

What is personal financial planning?

Personal finance is about managing your own money to achieve your goals at home and work. This involves knowing where your money is going, what you can afford, as well as balancing your wants and needs.

You can become financially independent by mastering these skills. That means you no longer have to depend on anyone for financial support. You can forget about worrying about rent, utilities, or any other monthly bills.

And learning how to manage your money doesn't just help you get ahead. It can make you happier. When you feel good about your finances, you tend to be less stressed, get promoted faster, and enjoy life more.

Who cares about personal finance anyway? Everyone does! Personal finance is the most popular topic on the Internet. Google Trends shows that searches for "personal finances" have increased by 1,600% in the past four years.

Today's smartphone users use their phones to compare prices, track budgets and build wealth. You can find blogs about investing here, as well as videos and podcasts about personal finance.

Bankrate.com estimates that Americans spend on average 4 hours per day viewing TV, listening to music and playing video games, as well reading books and talking with friends. It leaves just two hours each day to do everything else important.

If you are able to master personal finance, you will be able make the most of it.

Why is personal finance important?

Anyone who is serious about financial success must be able to manage their finances. We live in a world with tight finances and must make tough decisions about how we spend our hard earned cash.

Why should we save money when there are better things? Is there anything better to spend our energy and time on?

The answer is yes and no. Yes, because most people feel guilty if they save money. Because the more money you earn the greater the opportunities to invest.

You'll always be able justify spending your money wisely if you keep your eyes on the bigger picture.

It is important to learn how to control your emotions if you want to become financially successful. You won't be able to see the positive aspects of your situation and will have no support from others.

It is possible to have unrealistic expectations of how much you will accumulate. This is because you haven't learned how to manage your finances properly.

Once you have mastered these skills you will be ready for the next step, learning how budgeting works.

Budgeting is the practice of setting aside some of your monthly income for future expenses. By planning, you can avoid making unnecessary purchases and ensure that you have sufficient funds to cover your bills.

You now have the knowledge to efficiently allocate your resources and can start to see a brighter financial future.

How to build a passive stream of income?

To earn consistent earnings from the same source, it is important to understand why people make purchases.

That means understanding their needs and wants. You need to know how to connect and sell to people.

The next step is to learn how to convert leads in to sales. To keep clients happy, you must be proficient in customer service.

Although you might not know it, every product and service has a customer. You can even design your entire business around that buyer if you know what they are.

A lot of work is required to become a millionaire. To become a billionaire, it takes more effort. Why? Why?

Then, you will need to become millionaire. And finally, you have to become a billionaire. You can also become a billionaire.

How do you become a billionaire. It starts by being a millionaire. You only need to begin making money in order to reach this goal.

But before you can begin earning money, you have to get started. Let's now talk about how you can get started.

How much debt is considered excessive?

There is no such thing as too much cash. Spending more than you earn will eventually lead to cash shortages. Savings take time to grow. When you run out of money, reduce your spending.

But how much is too much? There's no right or wrong number, but it is recommended that you live within 10% of your income. That way, you won't go broke even after years of saving.

If you earn $10,000 per year, this means you should not spend more than $1,000 per month. You should not spend more than $2,000 a month if you have $20,000 in annual income. And if you make $50,000, you shouldn't spend more than $5,000 per month.

It's important to pay off any debts as soon and as quickly as you can. This includes credit card bills, student loans, car payments, etc. When these are paid off you'll have money left to save.

You should also consider whether you would like to invest any surplus income. If you decide to put your money toward stocks or bonds, you could lose money if the stock market falls. If you save your money, interest will compound over time.

Consider, for example: $100 per week is a savings goal. It would add up towards $500 over five-years. In six years you'd have $1000 saved. You'd have almost $3,000 in savings by the end of eight years. In ten years you would have $13,000 in savings.

You'll have almost $40,000 sitting in your savings account at the end of fifteen years. Now that's quite impressive. If you had made the same investment in the stock markets during the same time, you would have earned interest. Instead of $40,000, your net worth would be more than $57,000.

It is important to know how to manage your money effectively. A poor financial management system can lead to you spending more than you intended.

Is there a way to make quick money with a side hustle?

If you really want to make money fast, you'll have to do more than create a product or service that solves a problem for someone.

You must also find a way of establishing yourself as an authority in any niche that you choose. It's important to have a strong online reputation.

Helping people solve problems is the best way build a reputation. It is important to consider how you can help the community.

Once you have answered this question, you will be able immediately to determine which areas are best suited for you. Online earning money is possible in many ways. However, these opportunities are often highly competitive.

But when you look closely, you can see two main side hustles. The one involves selling direct products and services to customers. While the other involves providing consulting services.

Each approach has its pros and cons. Selling products and services can provide instant gratification since once you ship the product or deliver the service, payment is received immediately.

On the flip side, you might not reach the level of success you desire unless you spend time developing relationships with potential clients. Additionally, there is intense competition for these types of gigs.

Consulting is a great way to expand your business, without worrying about shipping or providing services. But, it takes longer to become an expert in your chosen field.

You must learn to identify the right clients in order to be successful at each option. This can take some trial and error. But in the long run, it pays off big time.

How do wealthy people earn passive income through investing?

There are two ways you can make money online. One is to create great products/services that people love. This is called "earning” money.

The second is to find a method to give value to others while not spending too much time creating products. This is what we call "passive" or passive income.

Let's say that you own an app business. Your job involves developing apps. You decide to give away the apps instead of making them available to users. Because you don't rely on paying customers, this is a great business model. Instead, you can rely on advertising revenue.

Customers may be charged monthly fees in order to sustain your business while you are building it.

This is how internet entrepreneurs who are successful today make their money. They give value to others rather than making stuff.

Statistics

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

External Links

How To

You can increase cash flow by using passive income ideas

It is possible to make money online with no hard work. There are many ways to earn passive income online.

You may already have an existing business that could benefit from automation. If you are thinking of starting a business, you might find that automating parts of your workflow can help you save time and increase productivity.

The more automated your business becomes, the more efficient it will become. This will enable you to devote more time to growing your business instead of running it.

A great way to automate tasks is to outsource them. Outsourcing allows you and your company to concentrate on what is most important. When you outsource a task, it is effectively delegating the responsibility to another person.

This means that you can focus on the important aspects of your business while allowing someone else to manage the details. Outsourcing makes it easier to grow your business because you won't have to worry about taking care of the small stuff.

Turn your hobby into a side-business. Using your skills and talents to create a product or service that can be sold online is another way to generate extra cash flow.

You might consider writing articles if you are a writer. Your articles can be published on many websites. These websites pay per article, allowing you to earn extra monthly cash.

Also, you can create videos. You can upload videos to YouTube and Vimeo via many platforms. Posting these videos will increase traffic to your social media pages and website.

You can also invest in stocks or shares to make more money. Investing is similar as investing in real property. You get dividends instead of rent.

You receive shares as part of your dividend, when you buy shares. The amount of your dividend will depend on how much stock is purchased.

If your shares are sold later, you can reinvest any profits back into purchasing more shares. You will keep receiving dividends for as long as you live.