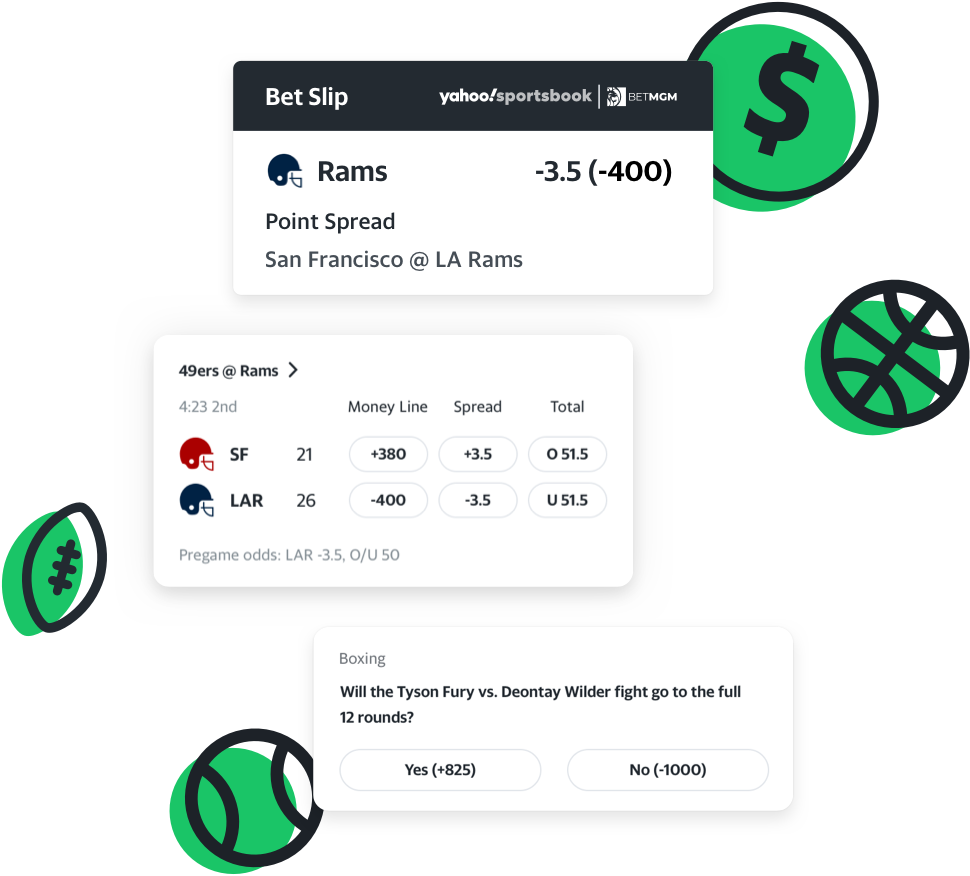

Money line odds is a way to predict the outcome of a game that has no handicap. These odds are offered to both the favourite and the underdog. They are more lucrative than a point spread. Additionally, the money line for underdogs will usually be lower. This makes money line betting more appealing for bettors.

Moneyline odds can be viewed as a two-way market

Moneyline betting, which is popular for wagering on sporting events, is very popular. This type is a way to align the interests of both the team and the punters. Football betting is a great example. The moneyline odds is lower than that of the point spread. If two teams are equally matched, the moneyline is the best way of betting on the outcome.

Moneyline odds for the regular season will include overtime. Moneylines will not be settled in the postseason. There are no ties in the NFL. Moneyline odds are based on the probability that a team will win by a certain number of points. A strategy is essential when betting on moneyline.

They are given to both underdogs as well as favorites

It is not unusual to see money lines awarded to both underdogs or favorites when betting on sporting events. These numbers indicate the "betting line", and they take into consideration which team is considered to offer a better chance. You can spot areas where the money lines are not as expected if you have sharp eyes.

The money line shows the chances of a team winning the game. The odds of the favorite winning will be higher than those of the underdog. A favorite will also have greater experience, coaching skills, and a more successful track record. They will do a better job of matching up with the opponent team than the underdog. The underdog is often less talented, has less experience, or has inexperienced coaches.

They do not need to be handicapped

Money lines are used for sports betting and can be used to predict the outcome of a game without using a point spread. Moneyline betting requires you to choose the winner of a game, which is not possible with point spreads. In a game with no point spread, the favorite side usually pays lower odds than that of the underdog. This encourages punters to wager on the underdog. Moneyline bets may increase the payout for a parlay.

They pay out quicker than a point spread wager

A money line can be used to predict which type or bet will pay faster. The money line pays out quicker than a point spread bet if a team is favoured by a certain amount. Money lines are usually offered during close games. The money line may be offered during college football games where the point spread cannot be met.

It is important to remember that money lines can win or lose games in many ways. This is because point spreads may not accurately reflect final score. Therefore, you could lose a bet if your team doesn't win. But, betting on a team that beats their point spread by a wide margin can still result in a win.

FAQ

How do rich people make passive income?

If you're trying to create money online, there are two ways to go about it. Another way is to make great products (or service) that people love. This is called earning money.

The second is to find a method to give value to others while not spending too much time creating products. This is what we call "passive" or passive income.

Let's say you own an app company. Your job is developing apps. But instead of selling the apps to users directly, you decide that they should be given away for free. That's a great business model because now you don't depend on paying users. Instead, you rely upon advertising revenue.

Customers may be charged monthly fees in order to sustain your business while you are building it.

This is how the most successful internet entrepreneurs make money today. They focus on providing value to others, rather than making stuff.

What is personal finance?

Personal finance is the art of managing your own finances to help you achieve your financial goals. This includes understanding where your money is going and knowing how much you can afford. It also involves balancing what you want against what your needs are.

Learning these skills will make you financially independent. You won't need to rely on anyone else for your needs. You can forget about worrying about rent, utilities, or any other monthly bills.

And learning how to manage your money doesn't just help you get ahead. It makes you happier overall. Feeling good about your finances will make you happier, more productive, and allow you to enjoy your life more.

Who cares about personal finance anyway? Everyone does! Personal finance is one of the most popular topics on the Internet today. Google Trends shows that searches for "personal finances" have increased by 1,600% in the past four years.

Today's smartphone users use their phones to compare prices, track budgets and build wealth. These people read blogs like this one and watch YouTube videos about personal finance. They also listen to podcasts on investing.

Bankrate.com says that Americans spend on the average of four hours per day watching TV and listening to music. They also spend time surfing the Web, reading books, or talking with their friends. It leaves just two hours each day to do everything else important.

When you master personal finance, you'll be able to take advantage of that time.

Why is personal finance so important?

Anyone who is serious about financial success must be able to manage their finances. In a world of tight money, we are often faced with difficult decisions about how much to spend.

So why do we put off saving money? Is there something better to invest our time and effort on?

The answer is yes and no. Yes, because most people feel guilty when they save money. You can't, as the more money that you earn, you have more investment opportunities.

You'll always be able justify spending your money wisely if you keep your eyes on the bigger picture.

To become financially successful, you need to learn to control your emotions. If you are focusing on the negative aspects of your life, you will not have positive thoughts that can support you.

It is possible to have unrealistic expectations of how much you will accumulate. This is because your financial management skills are not up to par.

These skills will prepare you for the next step: budgeting.

Budgeting is the act or practice of setting aside money each month to pay for future expenses. By planning, you can avoid making unnecessary purchases and ensure that you have sufficient funds to cover your bills.

Once you have mastered the art of allocating your resources efficiently, you can look forward towards a brighter financial tomorrow.

How to create a passive income stream

To earn consistent earnings from the same source, it is important to understand why people make purchases.

It is important to understand people's needs and wants. It is important to learn how to communicate with people and to sell to them.

The next step is to learn how to convert leads in to sales. The final step is to master customer service in order to keep happy clients.

Although you might not know it, every product and service has a customer. If you know the buyer, you can build your entire business around him/her.

You have to put in a lot of effort to become millionaire. To become a billionaire, it takes more effort. Why? Why?

You can then become a millionaire. The final step is to become a millionaire. It is the same for becoming a billionaire.

How does one become a billionaire, you ask? You must first be a millionaire. You only need to begin making money in order to reach this goal.

You have to get going before you can start earning money. Let's discuss how to get started.

Which passive income is easiest?

There are tons of ways to make money online. Many of these methods require more work and time than you might be able to spare. So how do you create an easy way for yourself to earn extra cash?

Find something that you are passionate about, whether it's writing, design, selling, marketing, or blogging. and monetize that passion.

For example, let's say you enjoy creating blog posts. Create a blog to share useful information on niche-related topics. You can sign readers up for emails and social media by clicking on the links in the articles.

This is affiliate marketing. There are lots of resources that will help you get started. Here's a collection of 101 affiliate marketing tips & resources.

A blog could be another way to make passive income. This time, you'll need a topic to teach about. You can also make your site monetizable by creating ebooks, courses and videos.

Although there are many ways to make money online you can choose the easiest. Make sure you focus your efforts on creating useful websites and blogs if you truly want to make a living online.

Once you've built your website, promote it through social media sites like Facebook, Twitter, LinkedIn, Pinterest, Instagram, YouTube and more. This is known as content marketing and it's a great way to drive traffic back to your site.

What is the distinction between passive income, and active income.

Passive income can be defined as a way to make passive income without any work. Active income requires effort and hard work.

If you are able to create value for somebody else, then that's called active income. It is when someone buys a product or service you have created. Examples include creating a website, selling products online and writing an ebook.

Passive income is great as it allows you more time to do important things while still making money. Most people aren’t keen to work for themselves. Instead, they decide to focus their energy and time on passive income.

Passive income isn't sustainable forever. If you wait too long before you start to earn passive income, it's possible that you will run out.

Also, you could burn out if passive income is not generated in a timely manner. So it's best to start now. You will miss opportunities to maximize your earnings potential if you put off building passive income.

There are three types passive income streams.

-

Businesses - these include owning a franchise, starting a blog, becoming a freelancer, and renting out the property such as real estate

-

Investments - These include stocks, bonds and mutual funds as well ETFs.

-

Real Estate: This covers buying land, renting out properties, flipping houses and investing into commercial real estate.

Statistics

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

External Links

How To

How to make money online

It is much easier to make money online than it was 10 years ago. Your investment strategy is changing. There are many ways that you can make passive income. But, they all require a large initial investment. Some methods are more difficult than others. Before you start investing your hard-earned money in any endeavor, you must consider these important points.

-

Find out what kind of investor you are. PTC sites are a great way to quickly make money. You get paid to click ads. Affiliate marketing is a better option if you are more interested in long-term earnings potential.

-

Do your research. Before you commit to any program, you must do your homework. Review, testimonials and past performance records are all good places to start. You don’t want to spend your time and energy on something that doesn’t work.

-

Start small. Don't jump straight into one large project. Instead, build something small first. This will allow you to learn the ropes and help you decide if this business is for you. Once you feel confident enough to take on larger projects.

-

Get started now! You don't have to wait too long to start making money online. Even if it's been years since you last worked full-time, you still have enough time to build a solid portfolio niche websites. All that's required is a good idea as well as some commitment. Take action now!