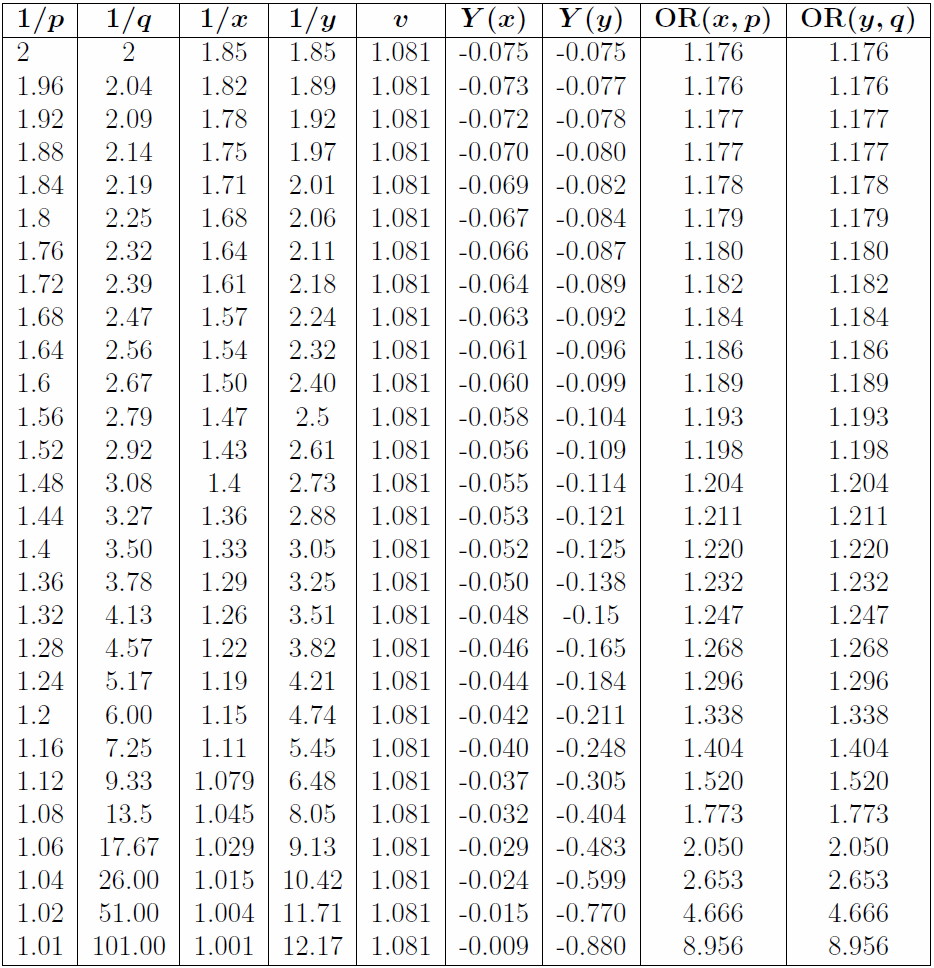

Learning how to read odds is key to making smart and profitable bets on sports. Sports odds are usually displayed in three formats: Decimal odds, Fractional odds, and American odds. These odds give you the chance of winning or losing and also the probability of it happening. You should choose the odds with the highest value when choosing which ones to place your bets on. But, sports betting results will be affected and influenced by many factors. It is not wise to solely depend on odds.

Decimal odds

Although you may have heard about decimal odds, you may not be familiar with how they work. It can be hard to decide whether you want to place a wager on a specific sport if you don't understand them. They are much more understandable than fractions. For those still unsure, you can use this handy decimal odds calculator.

In most sports betting situations, you'll find decimal odds on point spreads or totals. If the Chiefs are considered the heavy favorite, the odds of them winning are 1.13. Meanwhile, the Steelers are 6.50 on the moneyline. The odds of these teams winning are quite similar, although they are vastly different.

American odds

American sports betting is something you might be familiar with if your passion is football. These are the odds that a game will be played. They are also used for sports betting. The odds for different kinds of games depend on the market, so they can change at any time. It is important to understand the American sports odds and how they work.

The odds of success are expressed in positive or negative numbers. The negative number represents the favored team, while the positive number represents the underdog. Spread betting is the most popular bet. This evens the playing field between the two teams.

Moneyline odds

There are many ways you can bet on sport. Understanding how sports moneyline odds works is key to predicting the winner. Sportsbooks determine moneyline odds by computing implied probabilities. If a team is favored to win, the moneyline odds will be higher. The moneyline odds for an underdog are lower.

The moneyline odds consider not only the total implied probabilities but also matchups. One example is that a team that is heavily favored to win could struggle to contain a running back pass-catcher. A strong defensive line may make it difficult for an opponent to stop a strong defender. These considerations also apply to hockey and baseball.

FAQ

Why is personal financing important?

Anyone who is serious about financial success must be able to manage their finances. We live in a world with tight finances and must make tough decisions about how we spend our hard earned cash.

Why then do we keep putting off saving money. Is there anything better to spend our energy and time on?

Yes and no. Yes because most people feel guilty about saving money. You can't, as the more money that you earn, you have more investment opportunities.

Spending your money wisely will be possible as long as you remain focused on the larger picture.

Controlling your emotions is key to financial success. If you are focusing on the negative aspects of your life, you will not have positive thoughts that can support you.

Unrealistic expectations may also be a factor in how much you will end up with. This is because you haven't learned how to manage your finances properly.

Once you have mastered these skills you will be ready for the next step, learning how budgeting works.

Budgeting is the act or practice of setting aside money each month to pay for future expenses. Planning will save you money and help you pay for your bills.

You now have the knowledge to efficiently allocate your resources and can start to see a brighter financial future.

What is the distinction between passive income, and active income.

Passive income is when you earn money without doing any work. Active income requires work and effort.

When you make value for others, that is called active income. When you earn money because you provide a service or product that someone wants. This could include selling products online or creating ebooks.

Passive income is great as it allows you more time to do important things while still making money. Most people aren’t keen to work for themselves. Therefore, they opt to earn passive income by putting their efforts and time into it.

The problem with passive income is that it doesn't last forever. You might run out of money if you don't generate passive income in the right time.

In addition to the danger of burnout, if you spend too many hours trying to generate passive income, You should start immediately. If you wait too long to begin building passive income you will likely miss out on potential opportunities to maximize earnings.

There are three types or passive income streams.

-

There are many options for businesses: You can own a franchise, start a blog, become a freelancer or rent out real estate.

-

These investments include stocks and bonds as well as mutual funds and ETFs.

-

Real Estate - These include buying land, flipping houses and investing in real estate.

How to build a passive stream of income?

You must understand why people buy the things they do in order to generate consistent earnings from a single source.

This means that you must understand their wants and needs. Learn how to connect with people to make them feel valued and be able to sell to them.

You must then figure out how you can convert leads into customers. To retain happy customers, you need to be able to provide excellent customer service.

You may not realize this, but every product or service has a buyer. And if you know who that buyer is, you can design your entire business around serving him/her.

It takes a lot of work to become a millionaire. To become a billionaire, it takes more effort. Why? You must first become a thousandaire in order to be a millionaire.

Then, you will need to become millionaire. Finally, you can become a multi-billionaire. The same applies to becoming a millionaire.

So how does someone become a billionaire? It starts by being a millionaire. All you need to do to achieve this is to start making money.

However, before you can earn money, you need to get started. So let's talk about how to get started.

How does rich people make passive income from their wealth?

There are two main ways to make money online. Another way is to make great products (or service) that people love. This is called earning money.

The second way is to find a way to provide value to others without spending time creating products. This is what we call "passive" or passive income.

Let's suppose you have an app company. Your job is to develop apps. But instead of selling the apps to users directly, you decide that they should be given away for free. That's a great business model because now you don't depend on paying users. Instead, you can rely on advertising revenue.

To help you pay your bills while you build your business, you may also be able to charge customers monthly.

This is how successful internet entrepreneurs today make their money. They give value to others rather than making stuff.

How much debt is too much?

It is vital to realize that you can never have too much money. Spending more than what you earn can lead to cash running out. This is because savings takes time to grow. So when you find yourself running low on funds, make sure you cut back on spending.

But how much is too much? There isn't an exact number that applies to everyone, but the general rule is that you should aim to live within 10% of your income. You'll never go broke, even after years and years of saving.

This means that if you make $10,000 yearly, you shouldn't spend more than $1,000 monthly. If you make $20,000 per year, you shouldn't spend more then $2,000 each month. Spend no more than $5,000 a month if you have $50,000.

This is where the key is to pay off all debts as quickly and easily as possible. This includes student loans and credit card bills. When these are paid off you'll have money left to save.

It would be best if you also considered whether or not you want to invest any of your surplus income. If the stock market drops, your money could be lost if you put it towards bonds or stocks. However, if the money is put into savings accounts, it will compound over time.

Consider, for example: $100 per week is a savings goal. This would add up over five years to $500. Over six years, that would amount to $1,000. In eight years, you'd have nearly $3,000 in the bank. When you turn ten, you will have almost $13,000 in savings.

In fifteen years you will have $40,000 saved in your savings. Now that's quite impressive. You would earn interest if the same amount had been invested in the stock exchange during the same period. Instead of $40,000, you'd now have more than $57,000.

It's crucial to learn how you can manage your finances effectively. You might end up with more money than you expected.

How can a beginner generate passive income?

Begin with the basics. Next, learn how you can create value for yourself and then look at ways to make money.

You may even have a few ideas already. If you do, great! However, if not, think about what you can do to add value to the world and how you can put those thoughts into action.

Finding a job that matches your interests and skills is the best way to make money online.

There are many ways to make money while you sleep, such as by creating websites and apps.

But if you're more interested in writing, you might enjoy reviewing products. Or if you're creative, you might consider designing logos or artwork for clients.

Whatever your focus, choose something you are passionate about. If you enjoy it, you will stick with the decision for the long-term.

Once you have found a product/service that you enjoy selling, you will need to find a way to make it monetizable.

There are two main options. You can charge a flat price for your services (like a freelancer), but you can also charge per job (like an agency).

Either way, once you have established your rates, it's time to market them. This means sharing them on social media, emailing your list, posting flyers, etc.

Keep these three tips in your mind as you promote your business to increase your chances of success.

-

You are a professional. When you work in marketing, act like one. You never know who will be reviewing your content.

-

Be knowledgeable about the topic you are discussing. A fake expert is not a good idea.

-

Emailing everyone in your list is not spam. Send a recommendation directly to anyone who asks.

-

Make sure to choose a quality email provider. Yahoo Mail, Gmail, and Yahoo Mail are both free.

-

Monitor your results. Track who opens your messages, clicks on links, and signs up for your mailing lists.

-

You can measure your ROI by measuring the number of leads generated for each campaign and determining which campaigns are most successful in converting them.

-

Get feedback - ask friends and family whether they would be interested in your services, and get their honest feedback.

-

Test different tactics - try multiple strategies to see which ones work better.

-

Learn and keep growing as a marketer to stay relevant.

Statistics

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

External Links

How To

How to make money even if you are asleep

It is essential that you can learn to sleep while you are awake in order to be successful online. You must learn to do more than just wait for people to click on your link and buy your product. Making money at night is essential.

This requires that you create an automated system which makes money automatically without having to do anything. To do that, you must master the art of automation.

It would help if you became an expert at building software systems that perform tasks automatically. That way, you can focus on making money while you sleep. You can automate your job.

You can find these opportunities by creating a list of daily problems. Consider automating them.

Once you do that, you will probably find that there are many other ways to make passive income. Now, you have to figure out which would be most profitable.

If you're a webmaster, you might be able to create a website creator that automates the creation and maintenance of websites. You might also be able to create templates for logo production that you can use in an automated way if you're a graphic designer.

A software program could be created if you are an entrepreneur to allow you to manage multiple customers simultaneously. There are many options.

Automating anything is possible as long as your creativity can solve a problem. Automation is the key to financial freedom.