Learning how to read odds is key to making smart and profitable bets on sports. Three types of sports odds are commonly displayed: Fractional odds (Decimal odds), American odds (Fractional odds) and American odds. These odds can tell you how much you will win or lose, and what the chances are that it will happen. The highest-value odds are the best to choose when placing your bets. You should remember, however, that sports betting results can be affected by many factors and it is not advisable to rely solely on odds.

Decimal odds

Although you may have heard about decimal odds, you may not be familiar with how they work. If you don't know what they are, it can be difficult to make a decision when betting on a particular sport. They are easier to understand that fractions. For those still unsure, you can use this handy decimal odds calculator.

Decimal odds for totals and point spreads are common in sports betting. For example: If the Chiefs are the heavy favorite then their odds are 1.13. The Steelers, however, are 6.50 on this moneyline. These odds are very similar, but they are significantly different.

American odds

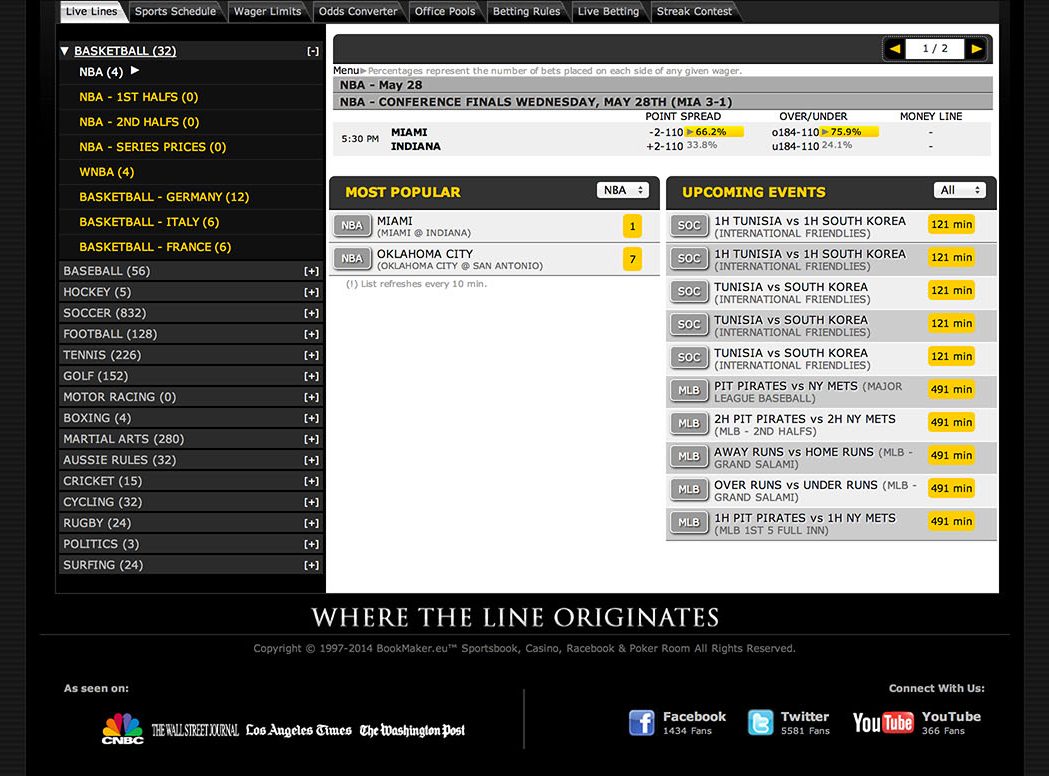

American sports odds is something that you might have come across if you are a fan of football. These are the odds for a specific game, which are used in sports betting. The market determines the odds for each type of game, so they are subject to change at any point. If you're looking to place a bet on a team, you need to understand how American sports odds work and what they mean.

You can see the odds in either positive numbers or negative numbers. The negative number indicates the team that is favored, and the positive number signifies the underdog. Spread is the most common type of bet. It evens out the playing fields between two teams.

Moneyline odds

There are many ways you can bet on sport. Understanding how sports moneyline odds works is key to predicting the winner. Moneyline odds are determined by computing implied probabilities. If a team is considered a favorite to win, then the moneyline odds are higher. The moneyline odds of an underdog team are lower.

The moneyline odds do not just consider total implied probabilities. They also take into consideration matchups. One example is that a team that is heavily favored to win could struggle to contain a running back pass-catcher. Similar to the above, an opposing team that has a strong offensive and defensive line might find it difficult to stop a strong defense. Special considerations are also required for hockey and baseball games.

FAQ

How much debt is too much?

It is essential to remember that money is not unlimited. If you spend more than you earn, you'll eventually run out of cash because it takes time for savings to grow. So when you find yourself running low on funds, make sure you cut back on spending.

But how much do you consider too much? Although there's no exact number that will work for everyone, it is a good rule to aim to live within 10%. This will ensure that you don't go bankrupt even after years of saving.

This means that if you make $10,000 yearly, you shouldn't spend more than $1,000 monthly. Spend less than $2,000 per monthly if you earn $20,000 a year. You shouldn't spend more that $5,000 per month if your monthly income is $50,000

It's important to pay off any debts as soon and as quickly as you can. This includes student loans and credit card bills. Once those are paid off, you'll have extra money left over to save.

It is best to consider whether or not you wish to invest any excess income. If you choose to invest your money in bonds or stocks, you may lose it if the stock exchange falls. However, if you put your money into a savings account you can expect to see interest compound over time.

Let's take, for example, $100 per week that you have set aside to save. That would amount to $500 over five years. In six years you'd have $1000 saved. In eight years, your savings would be close to $3,000 In ten years you would have $13,000 in savings.

After fifteen years, your savings account will have $40,000 left. That's pretty impressive. However, this amount would have earned you interest if it had been invested in stock market during the exact same period. Instead of $40,000 you would now have $57,000.

It is important to know how to manage your money effectively. You might end up with more money than you expected.

What is the distinction between passive income, and active income.

Passive income can be defined as a way to make passive income without any work. Active income requires effort and hard work.

When you make value for others, that is called active income. When you earn money because you provide a service or product that someone wants. Examples include creating a website, selling products online and writing an ebook.

Passive income is great as it allows you more time to do important things while still making money. Most people aren’t keen to work for themselves. They choose to make passive income and invest their time and energy.

Passive income doesn't last forever, which is the problem. If you wait too long before you start to earn passive income, it's possible that you will run out.

It is possible to burn out if your passive income efforts are too intense. So it's best to start now. You will miss opportunities to maximize your earnings potential if you put off building passive income.

There are 3 types of passive income streams.

-

Business opportunities include opening a franchise, creating a blog or freelancer, as well as renting out property like real estate.

-

These investments include stocks and bonds as well as mutual funds and ETFs.

-

Real Estate - this includes rental properties, flipping houses, buying land, and investing in commercial real estate

How to create a passive income stream

You must understand why people buy the things they do in order to generate consistent earnings from a single source.

That means understanding their needs and wants. It is important to learn how to communicate with people and to sell to them.

Next, you need to know how to convert leads to sales. You must also master customer service to retain satisfied clients.

Even though it may seem counterintuitive, every product or service has its buyer. If you know the buyer, you can build your entire business around him/her.

A lot of work is required to become a millionaire. It takes even more to become billionaire. Why? To become a millionaire you must first be a thousandaire.

You can then become a millionaire. And finally, you have to become a billionaire. You can also become a billionaire.

How can someone become a billionaire. It all starts with becoming a millionaire. You only need to begin making money in order to reach this goal.

Before you can start making money, however, you must get started. Let's take a look at how we can get started.

What is personal finance?

Personal finance refers to managing your finances in order to achieve your personal and professional goals. This includes understanding where your money is going and knowing how much you can afford. It also involves balancing what you want against what your needs are.

By mastering these skills, you'll become financially independent, which means you don't depend on anyone else to provide for you. You don't need to worry about monthly rent and utility bills.

You can't only learn how to manage money, it will help you achieve your goals. You'll be happier all around. Feeling good about your finances will make you happier, more productive, and allow you to enjoy your life more.

Who cares about personal finance anyway? Everyone does! Personal finance is the most popular topic on the Internet. According to Google Trends, searches for "personal finance" increased by 1,600% between 2004 and 2014.

Today's smartphone users use their phones to compare prices, track budgets and build wealth. You can find blogs about investing here, as well as videos and podcasts about personal finance.

Bankrate.com says that Americans spend on the average of four hours per day watching TV and listening to music. They also spend time surfing the Web, reading books, or talking with their friends. Only two hours are left each day to do the rest of what is important.

Financial management will allow you to make the most of your financial knowledge.

What are the top side hustles that will make you money in 2022

The best way to make money today is to create value for someone else. You will make money if you do this well.

While you might not know it, your contribution to the world has been there since day one. When you were a baby, you sucked your mommy's breast milk and she gave you life. Learning to walk gave you a better life.

You will always make more if your efforts are to be a positive influence on those around you. You'll actually get more if you give more.

Value creation is a powerful force that everyone uses every day without even knowing it. You create value every day, whether you are cooking for your family, driving your children to school, emptying the trash or just paying the bills.

Today, Earth is home for nearly 7 million people. Each person creates an incredible amount of value every day. Even if you create only $1 per hour of value, you would be creating $7,000,000 a year.

It means that if there were ten ways to add $100 to the lives of someone every week, you'd make $700,000.000 extra per year. That's a huge increase in your earning potential than what you get from working full-time.

Now, let's say you wanted to double that number. Let's assume you discovered 20 ways to make $200 more per month for someone. Not only would this increase your annual income by $14.4 million, but it also makes you extremely rich.

Every day there are millions of opportunities for creating value. Selling products, services and ideas is one example.

Although our focus is often on income streams and careers, these are not the only things that matter. Ultimately, the real goal is to help others achieve theirs.

To get ahead, you must create value. You can get my free guide, "How to Create Value and Get Paid" here.

What's the best way to make fast money from a side-hustle?

If you want money fast, you will need to do more than simply create a product/service to solve a problem.

You need to be able to make yourself an authority in any niche you choose. It means building a name online and offline.

Helping people solve problems is the best way build a reputation. You need to think about how you can add value to your community.

Once you've answered the question, you can immediately identify which areas of your expertise. There are many ways to make money online.

You will see two main side hustles if you pay attention. The one involves selling direct products and services to customers. While the other involves providing consulting services.

Each approach has its advantages and disadvantages. Selling products and services provides instant gratification because once you ship your product or deliver your service, you receive payment right away.

On the flip side, you might not reach the level of success you desire unless you spend time developing relationships with potential clients. Additionally, there is intense competition for these types of gigs.

Consulting allows you to grow and manage your business without the need to ship products or provide services. However, it takes time to become an expert on your subject.

If you want to succeed at any of the options, you have to learn how identify the right clients. It takes some trial and error. But in the long run, it pays off big time.

Statistics

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

External Links

How To

How to Make Money online

Making money online is very different today from 10 years ago. You have to change the way you invest your money. While there are many methods to generate passive income, most require significant upfront investment. Some methods are more difficult than others. You should be aware of these things if you are serious about making money online.

-

Find out what type of investor are you. PTC sites, which allow you to earn money by clicking on ads, might appeal to you if you are looking for quick cash. On the other hand, if you're more interested in long-term earning potential, then you might prefer to look at affiliate marketing opportunities.

-

Do your research. Before you commit to any program, you must do your homework. Look through past performance records, testimonials, reviews. You don't wish to waste your energy and time only to discover that the product doesn’t perform.

-

Start small. Don't jump straight into one large project. Start small and build something first. This will allow you to learn the ropes and help you decide if this business is for you. Once you feel confident enough, try expanding your efforts to bigger projects.

-

Get started now! It's never too soon to start making online money. Even if your job has been full-time for many years, there is still plenty of time to create a portfolio of niche websites that are profitable. All you need are a great idea and some dedication. So go ahead and take action today!